Since 2000, First Homes has been working to make the dream of homeownership more accessible for buyers. We do this by subsidizing homes and selling them at a lower cost to income-qualified buyers.

While First Homes works to make homeownership affordable, purchasing a First Homes property is not the right choice for everyone. Keep reading to learn more about the First Homes program to see if it’s a good option for you. Have more questions? Contact First Homes at emily@rochesterarea.org.

A Community Land Trust (CLT) is a sustainable affordable housing model that has been practiced across the U.S. since the 1960s. The goal of a CLT is to make homes affordable to buyers who may otherwise not be able to purchase a home and preserve the home’s affordability.

As the steward of a CLT, First Homes subsidizes homes to sell them at a lower cost and takes the cost of the land out of the purchase price. This allows income-qualified buyers to purchase the house itself for a more affordable price.

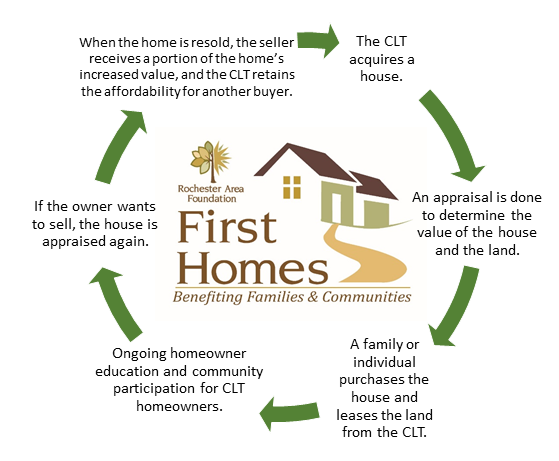

First Homes keeps a house affordable for the first buyer and all future buyers using the affordability cycle. Here’s how it works.

First Homes buys or builds a home and subsidizes it to sell the home at a lower cost. The home is then sold to an income-qualified buyer. The buyer enjoys all of the benefits of homeownership including building equity, housing security, and qualifying tax benefits.

When the homeowner decides to sell the home, the home is sold at a lower cost to another income-qualified buyer. The lower cost reflects the original subsidy and the increase in the home’s value.

The appraised equity (how much the home has increased in value) is shared between the seller and the home itself. This allows the seller to earn equity from the sale of the home while also building on the original subsidy in the home, allowing it to be sold at a lower cost.

A new buyer purchases the home and the cycle starts over.

While owning a CLT home is similar to owning a market-rate home, there are some important differences to consider.

First Homes is an income-qualified program. We operate at 80% of the area median income (AMI), so any household making at or below 80% AMI may income qualify for our program. AMI is updated yearly by The United States Department of Housing and Urban Development (HUD).

| Gross Household Income | Olmsted & Dodge Counties | Remaining Counties |

|---|---|---|

| 80% Area Median Income (AMI) | $100,500 | $93,600 |

(Current AMI as of 6/2/2025)

If you are interested in applying, please complete our registration form.

First Homes can be a great option for those struggling to afford a market-rate home, but it is not the right choice for everyone. Don’t hesitate to contact us for more information about the program.

Apply to the First Homes program by completing our no-commitment registration form below. This will provide our team with basic information to determine your eligibility, what kind of home you are looking for, and the next steps.