First Homes works to make the dream of homeownership possible for those who may otherwise be excluded from the housing market. We do this using the Community Land Trust (CLT) model, subsidizing homes to sell them at a lower cost. To keep homes affordable for future buyers, we use a shared-equity model. This means each subsequent buyer will benefit from the original subsidy in the face of rising housing costs.

While your experience as a CLT homeowner is very similar to that of a market-rate homeowner, there are a few differences. Find all of the information you need, from how to sell your home to your responsibilities as a homeowner, below. Still have questions? Contact us at emily@rochesterarea.org.

Part of how First Homes keeps homes affordable is by maintaining a deeded interest in the land the home is on. CLT homeowners lease the land from First Homes and are required to pay a monthly ground lease fee. and sign a ground lease. This document outlines the terms of the ground lease, including the resale formula, homeowner responsibilities, and procedures for selling your home.

While you should have a copy of your ground lease in your records that includes specifics about your home purchase, you can click here to view a sample copy. You can also click here to access a ground-lease-at-a-glance document which highlights some of the most important details in your ground lease.

If you need a copy of your ground lease, please contact us.

CLT homeowners share the same responsibilities as owners of market-rate homes. This includes, but is not limited to:

As a CLT homeowner, you are welcome to update your home. However, because of the terms of your ground lease, there are a few instances where First Homes needs to be notified of changes to the home. A good rule of thumb is that if you are changing the footprint of the home (building an addition or removing a part of the structure) you must get approval from First Homes of your plans and share all permits required for the project with First Homes.

If you are painting, replacing appliances, replacing the roof, installing landscaping, installing a fence, or performing other routine home maintenance and upgrades, First Homes does not need to be notified.

To support your success as a homeowner, First Homes offers a free post-purchase education program! Within the first year of owning your home, you can contact our licensed inspector partner and schedule an appointment for them to visit your home and show you how to maintain it.

After the appointment, have the inspector fill out the Preventive Maintenance Certificate and submit it to First Homes. Then, First Homes will pay for the appointment.

You should have received a Preventive Maintenance Certificate during orientation, but if you need a copy, please contact First Homes.

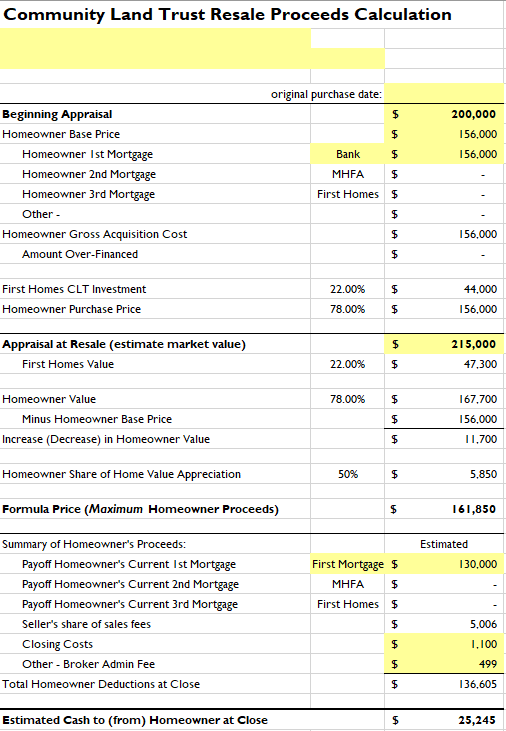

When you purchased your home, you benefitted from a subsidy that First Homes invested in the home, allowing it to be sold at a lower cost. To preserve the affordability of each house for future buyers, homeowners agree to sell their home at a lower cost and to share the appraised equity, or how much the home has increased in value.

This cost is determined using the resale formula found in your ground lease. Below is an example of of how the resale formula works.

Whether you are relocating for work or need more space for your growing family, when you are ready to sell your CLT home, we’re here to help!

| Company | Appraiser | Phone | |

|---|---|---|---|

| Northstar Realty Services | Brian Becker | 507-216-7105 | brian@nsrsvs.com |

| Real Property Appraisals | Brandon Kolpek | 507-202-0718 | brandon@kolpek.net |

| Rochester Area Appraisals | Mike Kielty | 507-285-1819 | kielty@raappraisals.net |

| Todd Pruismann Appraisals | Todd Pruismann | 507-251-3152 | toddpruismann@charter.net |

| Shelly Schad Appraisal Service | Shelly Schad | 507-273-3164 | schad@hbci.com |